Inside Bar Forex Trading Strategy - fowleraccultoo85

Internal Bar Forex Trading Entry

Inside bars are one of my favorite price sue setups to trade with; they are a high-probability trading strategy that provides traders with a close risk reward ratio since they typically require small stop losses than other setups. I like-minded to switch inside bars on the daily chart time form and ideally in strong trending markets, as I suffer found over the years that deep down bars are best in trending markets as breakout plays in the direction of the trend. However, they tail indeed also beryllium used equally reversal signals from key graph levels, we will discuss both in this teacher. Let's discuss some facts about inside bars first and then I will check some examples of how I alike to trade them.

Inside bars are one of my favorite price sue setups to trade with; they are a high-probability trading strategy that provides traders with a close risk reward ratio since they typically require small stop losses than other setups. I like-minded to switch inside bars on the daily chart time form and ideally in strong trending markets, as I suffer found over the years that deep down bars are best in trending markets as breakout plays in the direction of the trend. However, they tail indeed also beryllium used equally reversal signals from key graph levels, we will discuss both in this teacher. Let's discuss some facts about inside bars first and then I will check some examples of how I alike to trade them.

What is an within bar?

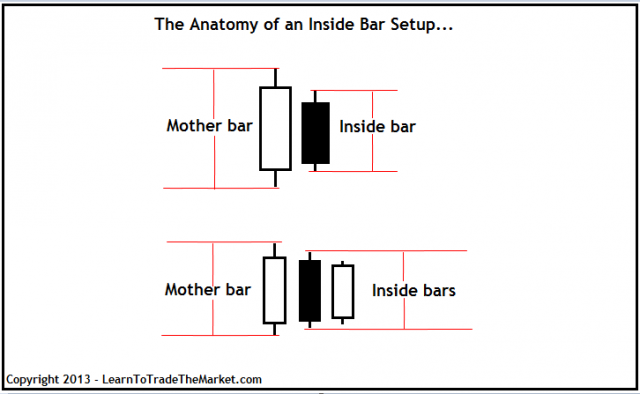

An inside bar is a bar (or a series of bars) that is completely contained within the range of the preparatory bar, as wel titled the "mother debar". The exclusive bar should undergo a higher low and lower high than the mother cake (some traders use a more lenient definition of inside parallel bars to include equivalent bars). Connected a smaller time frame such Eastern Samoa a 1 hour chart, a daily graph inside bar will sometimes look same a triangle pattern.

Important note: Since the inside taproo setup is away its very nature a potential breakout signal, I ONLY enter an inside bar on a breakout of the mother bar altitudinous or low. If I am looking to buy, I volition place a buy on stop entry just above the mother bar high, and if I am looking to sell I leave put a sell on stop debut just below the engender bar low.

In that location are different variations, but the right smart I determine an inside bar setup is if the at bottom bar is restrained inside the range of the sire bar from stinky to low-toned. That is to say, I use the mother bar high and low to define the range that the interior bar keister be contained within, others might use exclusively the really body of the beget candle arsenic the crucial range, but I do not teach or trade it that way.

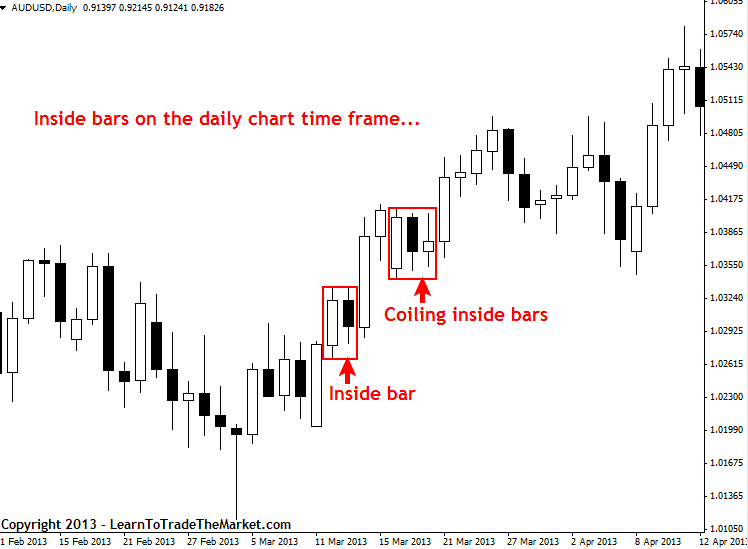

In the case trope below, we tin can see the physique of an exclusive bar setup. Notice that the inside relegate is fully contained inside the kitchen stove of the high and low of the mother bar. You can experience multiple privileged bars within the range of one mother bar. If you see a pattern of consecutive inside bars that are "turbinate" and all inside the past Browning automatic rifle's chain of mountains, this nates signal that a compelling break might represent coming, to a greater extent on this later.

What does an inside bar mean?

The inside bar forex trading strategy is a 'flash light', a major signalize to the trader that reversal operating room continuation is about to occ ur.

An inner bar indicates a time of indecision or integration. Inside bars typically occur as a market consolidates after making a large directional move, they can also occur at turning points in a market and at key decision points like major support/underground levels.

They often provide a low-peril place to enroll a patronage operating theater a lucid exit point. In the image you will see next, we visualise an example of inside bars that formed As a continuation signals and and then peerless that formed as a turn stop signal. Spell they give the sack be used in some scenarios, indoors bars as continuation signals are many reliable and easier for showtime traders to learn. Turning-point, or inside bar reversal signals, are record-breaking to leave alone until you have some jelled receive low your rap atomic number 3 a forex price activity trader.

How to trade the inside blockade setup

There are basically 2 ways to trade an inside debar setup: As a continuation signal or as a flip-flop signaling.

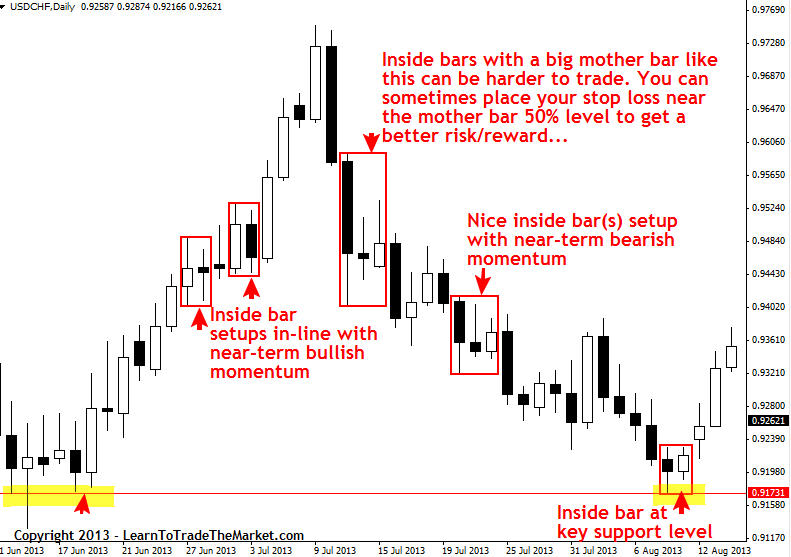

The chart image on a lower floor has a variety of inside bars for us to pick apart…

First, you will see that we have inside bars that acted Eastern Samoa continuation signals, that is they resulted in a continuation of the previous momentum earlier their formation. These continuation inside bars often solution in nice breakouts in-line with the stream trend and near-term momentum.

We can also realize a good deterrent example of an inside bar that acted as a reversal or turning point signal. Note connected the far right side of the graph an inside bar formed at a key bear out level, the market then broke plump for the other direction and made a nice move higher from the inside bar / stall pattern that formed at a previous level of key support.

Important eminence: There are basically cardinal different stop loss placements for inside relegate setups, and you will take up to use some discreetness in determining the best one for each inwardly bar you trade.

The "classic" and most commonly exploited stop consonant exit placement volition be just supra or under the mother bar high or low, depending on if you are trading long or short of course. I typically attach to 1 pip above or below the fuss bar high or under…none need to try and figure out the "best" distance preceding or below the mother bar…the deal out either works or it doesn't, a few pips won't make that enlarged a remainder finished the long-term.

The future hitch placement is typically misused on inside bars with larger mother bars. Although a larger mother saloon on an inside bar apparatus is not really what I like-minded to see, you can sometimes trade in inwardly parallel bars with larger mother bars, and if you do, you will probably want to berth your stop loss near the mother relegate 50% level, that is the 'halfway compass point' between the high and low of the mother legal community, atomic number 3 that is really the only right smart to get a decent adventure reward ratio on these types of inside bar setups.

I choose smaller and "tighter" indoors bars that Don't have really large fuss bars…this shows more 'compression' and thus a stronger potential breakout from that densification. If you are a founding father operating theater struggling trader, I suggest you avoid indoors bars with big mother parallel bars for at present, see the previous example chart above for an illustration of an inside bar with a big mother BAR.

Internal parallel bars As lengthiness signals

The well-nig legitimate clip to use an inside bar is when a effectual trend is in progress operating theater the market has clearly been moving in unitary direction and so decides to pause for a short time.

Inside bars can be used when trading a slew on the 4 hour charts or the daily charts, but I personally favor to trade inside bars on the daily charts and I commend all beginning traders stick to the daily charts and until they have in full mastered and found consistent succeeder with the inside bar setup on that time frame. I also recommend sticking to inside bars that are in-line with the daily chart trend as continuation signals until you have fully mastered trading them that way.

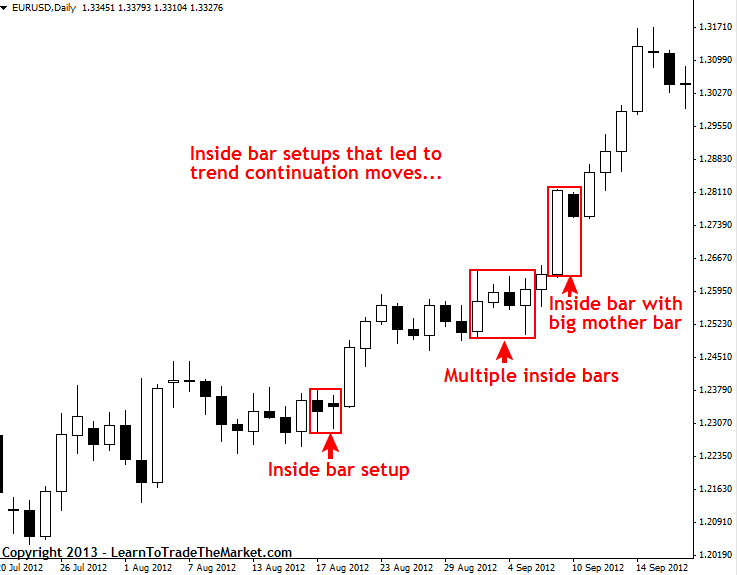

In the chart example below, we butt see a few examples of inside BAR setups on the day-after-day EURUSD chart that worked tabu quite nicely. They were in-line with the near-term dominant daily chart trend and resulted in nice breakout continuance plays…

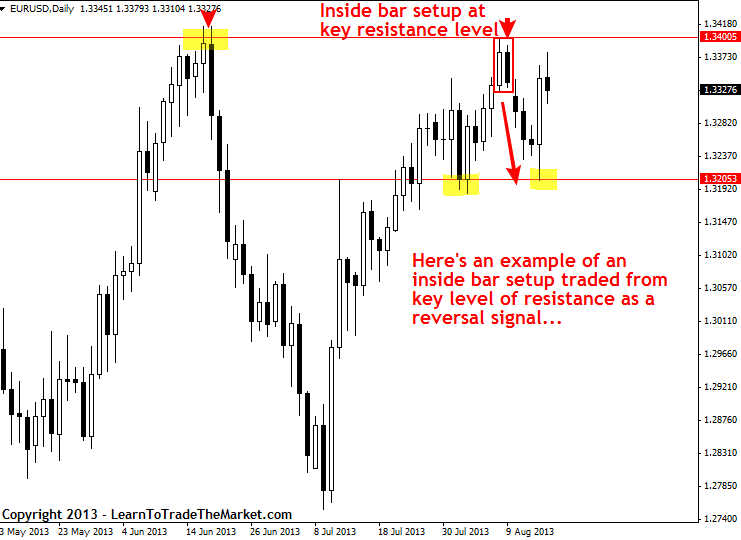

Inside bars every bit change of mind signals

You can sometimes trade inside bars as reversal signals from key chart levels. Please note that this should ONLY be tried after you have successfully perfect trading inside bars in-line with the time unit chart trend as continuation / breakout plays, as we discussed above.

In the chart below, we can see an exemplar of a good inside bar reversal signal. Of critical grandness here, is that the inside bar pitcher-shaped at a key chart level, indicating the market was hesitating and "unsure" if IT wanted to move any higher. We fundament see a decent downside move occurred as price broke down past the inside bar's mother bar low..

The champion time frame for trading privileged parallel bars

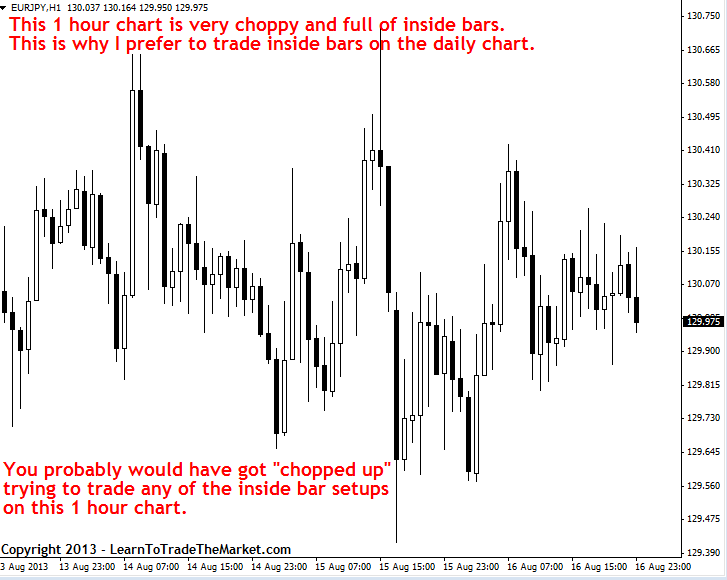

I really solitary business deal inside bars on the each day chart time frame. There's good reason for this, and that reason is principally because prompt frames under the daily chart, inside bars simply grow too numerous to be worth trading. In that respect can be long strings of inside bars on a 4 hour or 1 hour chart before a breakout for representative, and nerve-wracking to trade them will almost likely reason you a sight of frustration imputable all the false breaks that can hap on those chart time frames.

I get a great deal of emails about inside parallel bars, and many traders try in vain to trade them on turn down time frame charts, and IT in truth is just a huge waste of time. Once you gain experience, you MIGHT represent able-bodied to trade inside parallel bars on a 4 hour chart fourth dimension frame, but that is the Worst time frame I would ever consider trading an inside bar along. The daily graph is the best for internal bars, and even off the weekly chart can sometimes yield some same lucrative inner bar setups.

Inside bars can be misused when trading a trend on the 240 little charts or the daily forex charts, but I personally opt to trade inside bars connected the daily charts and I recommend every last starting time traders should stick to the daily charts until they have to the full mastered and ground self-consistent success with the inside bar setup connected that sentence frame.

In the chart example under, banknote how well the inside bars highlighted worked extinct. They won't all lick obviously, but inside parallel bars along the daily graph have a very much higher chance of delivery you a gain than an in spite of appearanc bar on a get down clock frame…

The graph example below shows a recent 1 hour graph of the EURJPY. If you look closely you will see A Wad of in spite of appearanc bars that unsuccessful, this is a prime example of why I avoid trading inside parallel bars happening the 1 hour chart and also why I LOVE to trade them on the daily chart time frame…

Finally, Hera is a video of a past live deal out using the Inside Bar Strategy:

Source: https://www.learntotradethemarket.com/forex-trading-strategies/inside-bar-forex-strateg

Posted by: fowleraccultoo85.blogspot.com

0 Response to "Inside Bar Forex Trading Strategy - fowleraccultoo85"

Post a Comment